Key Takeaways

- Article 6 of the Paris Agreement creates the global rulebook for international carbon markets through three mechanisms (6.2, 6.4, and 6.8), with corresponding adjustments and authorization requirements that directly affect how DACH companies can use carbon credits and make climate claims under CSRD and emerging Green Claims rules.

- You don't need Article 6 authorization for every credit you buy, but you do need a clear internal policy on when authorization matters for your claims—especially for "carbon neutral" or offsetting statements that will face heightened scrutiny from EU regulators and auditors.

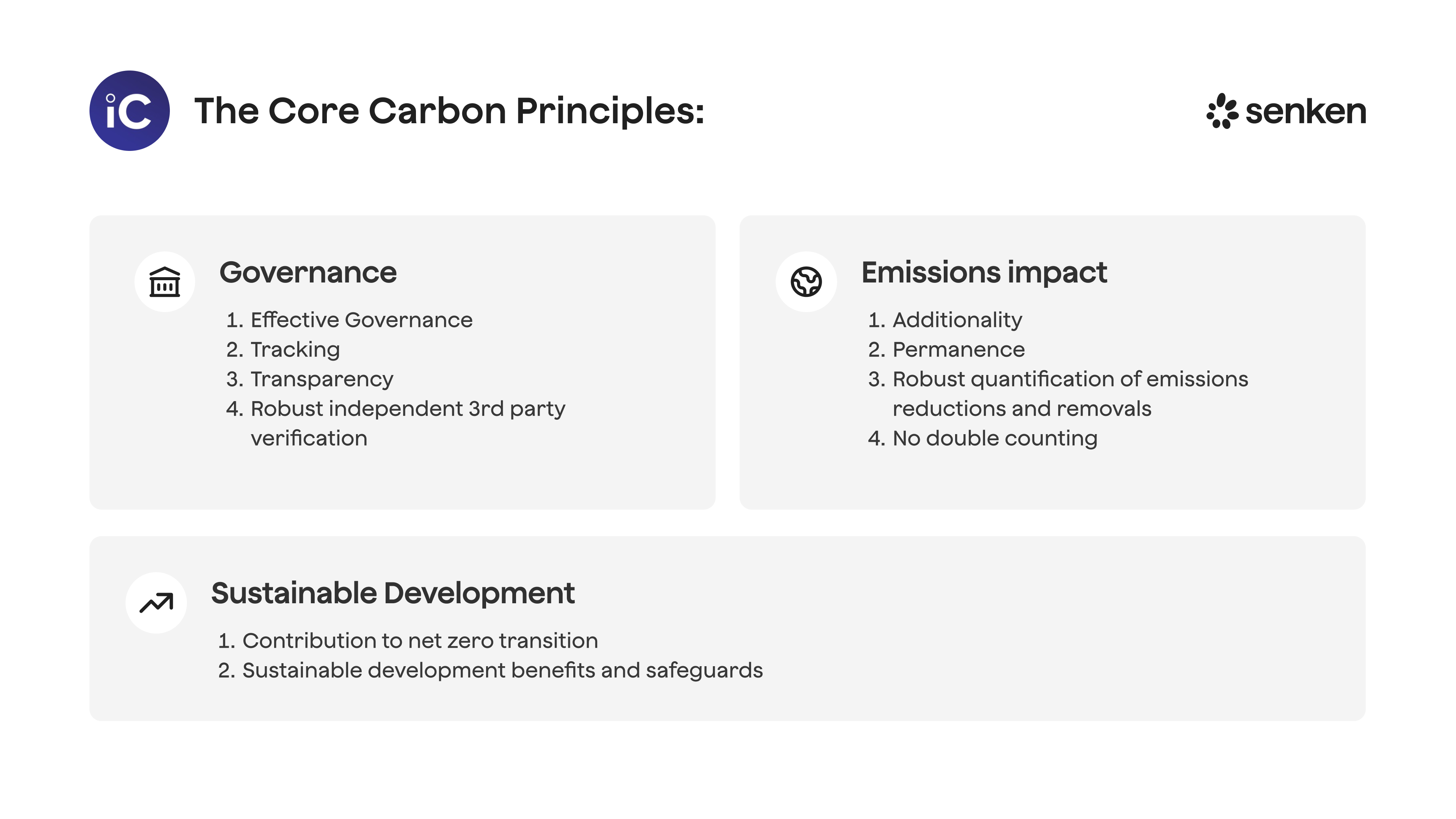

- Quality fundamentals (additionality, permanence, robust MRV) remain non-negotiable; Article 6 adds an NDC-accounting layer on top, not a shortcut—meaning "Article 6 compliant" doesn't automatically equal "high integrity" without proper due diligence.

- Build audit-ready evidence packs now: registry records with Article 6 labels, host-country authorization letters, corresponding adjustment documentation, and integrity assessments will become standard expectations in CSRD assurance and Green Claims substantiation within 12–18 months.

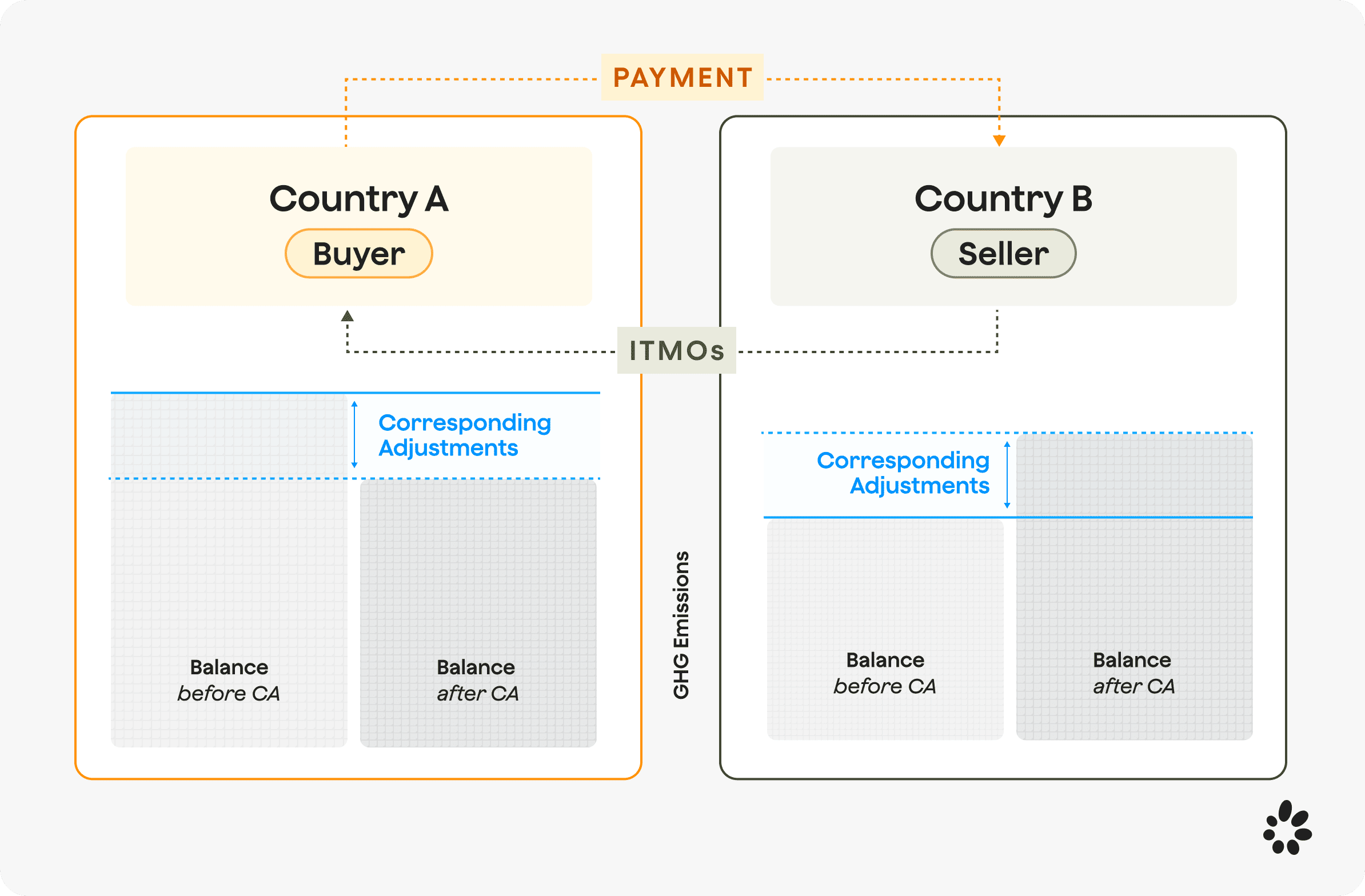

Article 6 of the Paris Agreement is no longer a distant policy concept debated at UN climate conferences—it's reshaping how large companies in Germany, Austria, and Switzerland can credibly use carbon credits in their net-zero strategies. Adopted in Paris in 2015 and operationalized through detailed rules finalized at COP26 in Glasgow (2021), Article 6 establishes the international framework for countries to cooperate on emissions reductions through carbon markets. It governs how mitigation outcomes can be traded between nations while preventing double counting through a system of authorization and corresponding adjustments.

For sustainability managers in DACH, this matters because Article 6 intersects directly with your CSRD/ESRS E1 reporting obligations, the upcoming EU Green Claims Directive, and board-level questions about carbon credit quality and greenwashing risk. As voluntary market demand shifts toward compliance-aligned, Article 6-ready credits—and auditors start asking for authorization documentation—you need a practical understanding of what Article 6 changes (and doesn't change) for your procurement strategy and climate claims. This guide cuts through the policy complexity to give you an audit-ready playbook: what Article 6 actually means for corporate buyers, when authorization matters for your use case, and how to build a defensible, high-integrity carbon credit strategy aligned with European regulations and scientific best practice.

What Is Article 6 of the Paris Agreement? (Simple Overview First)

Article 6 of the Paris Agreement is the rulebook that governs how countries cooperate on climate action through carbon markets and other mechanisms. Adopted in Paris in 2015 and operationalized through the Glasgow rulebook at COP26 in 2021, Article 6 creates the rules for international cooperation and carbon markets between countries through Internationally Transferred Mitigation Outcomes (ITMOs), the 6.4 mechanism, and non-market approaches .

.png)

While these rules apply at the country level, they directly shape what corporate buyers can do with carbon credits and how you communicate those purchases to boards, auditors, and regulators. Understanding Article 6 is no longer optional for large DACH companies navigating CSRD, Green Claims rules, and rising scrutiny on carbon credit quality.

Article 6.2: Cooperative approaches and ITMOs

Article 6.2 allows countries to trade Internationally Transferred Mitigation Outcomes (ITMOs) through bilateral or multilateral agreements, with requirements for authorization, first transfer, and corresponding adjustments to prevent double counting . For corporates, this matters when you purchase credits that a host country has authorized for international use. Switzerland has concluded 6.2 treaties with 16 countries including Peru, Ghana, Georgia, Thailand, and Uruguay, and completed the first reported ITMO transfer of 1,916 units from Thailand in January 2024 .

Article 6.4: The Paris Agreement Crediting Mechanism

Article 6.4 establishes a UN-supervised crediting mechanism to replace the Clean Development Mechanism (CDM), with host-Party authorization required and corresponding adjustments applied at first transfer of authorized units . The Supervisory Body has adopted initial methodologies and registry procedures, with first issuances expected in 2025–2026 once the registry is operational and methodologies are finalized . Your strategy should account for these units becoming available, but don't wait passively—high-integrity voluntary credits remain essential today.

Article 6.8: Non-market approaches

Article 6.8 covers non-market cooperative actions like capacity building, technology transfer, and policy coordination that do not involve carbon trading . While less directly relevant to credit procurement, these approaches signal the broader context in which host countries operate and can affect project enabling environments.

How Article 6 Changes – and Does Not Change – Corporate Carbon Credit Use

From simple offsets to NDC-accounted mitigation outcomes

Growing importance of host-country authorisation and corresponding adjustments for some use cases (e.g., compliance like CORSIA, strong "offsetting" claims) versus contribution-style use of high-integrity non-authorised credits. The key shift is traceability: you now need to know whether the credit you buy has been authorised by the host country and whether a corresponding adjustment has been or will be applied to that country's emissions accounting.

Major standards like Verra require Article 6 authorization and "Article 6 Authorized – International Mitigation Purposes" labels for post-2020 vintages used in CORSIA, with corresponding adjustments by host countries. Gold Standard has introduced similar registry functionality. This means your procurement team must ask suppliers: Has the host Party authorised this credit? For what purpose? Will a corresponding adjustment be made?

When authorisation matters:

- Compliance schemes:CORSIA eligibility for 2021+ vintages requires Article 6 authorisation and adjustment.

- Strong offsetting or neutrality claims in the EU: If you're making "carbon neutral" or "net zero" claims tied to credit purchases, regulators will scrutinise whether credits involve double counting. Article 6 authorisation and adjustment materially reduce this risk.

- Bilateral 6.2 transactions: When credits come from a national cooperative approach, verify the legal basis (treaty/MoU), the host Party's authorisation process, and maintain copies for audit.

When high-integrity non-authorised credits still work:

Not every credit needs authorisation. Where units are not authorised/adjusted (including 6.4 "mitigation contribution" credits), claims should be framed as financing or contribution to host mitigation rather than compensation of the buyer's footprint. This distinction between "contribution" and "offsetting" will become standard practice as SBTi's Beyond Value Chain Mitigation (BVCM) guidance evolves.

Double counting, corresponding adjustments and your claims

Corresponding adjustments require adding the quantity of ITMOs are authorised and first transferred, and subtracting the quantity used toward NDCs, ensuring mitigation outcomes are used within the same NDC implementation period as when they occurred. In plain terms: when a host country authorises a credit for your use, it must add that emission reduction back to its own national account so the same tonne isn't counted twice.

The implication for you: Article 6 adds an NDC-level accounting overlay; it is not a substitute for quality fundamentals like additionality, conservative baselines, permanence, and robust MRV, which remain baseline expectations . A credit can be "Article 6 compliant" in form but still weak on environmental integrity if the underlying methodology is poor. Conversely, a non-authorised credit can be exceptionally high quality and appropriate for contribution claims.

Article 6, CSRD and EU Rules: What DACH Sustainability Leaders Must Align On

CSRD/ESRS E1: separating gross emissions from credit use

CSRD's ESRS E1 requires companies to disclose gross emissions separately and be transparent on any carbon credit use, including the standard/mechanism, type, vintage, and Article 6 status, avoiding any implication that credits reduce reported inventory emissions unless clearly permitted . For your annual sustainability statement, this means a clear line between your Scope 1–3 footprint and any credits purchased for neutralisation or contribution.

Practically: expect your assurance provider to ask for a table showing every credit transaction with project ID, registry, methodology, vintage, volume, retirement proof, and—increasingly—Article 6 authorisation status. Building this dataset now saves scrambling during your first external audit.

Green Claims Directive and high-stakes climate marketing

The EU Green Claims Directive (proposal tabled in March 2023, Parliament first reading in March 2024) will require robust substantiation, third-party verification, and clear communication for explicit environmental claims, including climate and offsetting claims. The Directive will standardise evidence requirements across member states and tighten enforcement.

For any "carbon neutral," "climate positive," or similar claim, you'll need to prove:

- The scope and boundaries of the claim

- The quality and additionality of purchased credits

- Whether credits were authorised/adjusted (reducing double-claim risk)

- How you avoided greenwashing in your messaging

Article 6 authorisation and adjustment status will make or break the defensibility of offsetting claims in the EU context. If you're communicating net-zero milestones externally, your legal and comms teams should be aligned with procurement on which credits you buy and how they're described.

DACH specifics: Swiss 6.2 treaties and German/Austrian expectations

Switzerland's Federal Office for the Environment publishes official 6.2 treaties and clarifies that ITMOs authorized for "other international mitigation purposes" (e.g., private claims, CORSIA) are not counted toward the Swiss NDC . This transparency is gold for corporate buyers: if you're a Swiss company using ITMOs under one of these treaties, you have a clear legal basis and can point auditors to published authorization frameworks.

Germany and Austria don't yet have Article 6-specific corporate claims regulation, but CSRD/ESRS applies fully and the Green Claims Directive will set common EU rules. German companies under the Supply Chain Act (LkSG) must also consider environmental and social safeguards in procurement—Article 6 projects that meet UNFCCC sustainable development criteria help tick this box.

Designing an Article 6-Aligned Carbon Credit Strategy

Take stock: portfolio and claims audit

Start with what you already own or have contracted. For each credit vintage, document:

- Project name, ID, and registry

- Crediting mechanism (VCS, Gold Standard, ACR, legacy CDM, etc.)

- Country and methodology

- Vintage year and volume

- Article 6 status: authorized? For what purpose? Registry label present?

- How you've described these credits in reports, marketing, and board materials

This inventory will surface risks—legacy CDM units without host-country transition approval, projects using soon-to-be-invalidated methodologies, or claims language that assumes "offsetting" without authorization evidence. CDM activities registered after 1 January 2013 may transition to Article 6.4 subject to conditions, including host-Party approval by 31 December 2025, with a low conversion rate to date (approximately 6% of transition requests approved) . If you hold pre-2021 CERs, understand their limitations and plan replacements.

Decide your stance: when you require Article 6 authorization

Not every company needs 100% authorized credits, but you do need a clear, documented policy. Here's a simple decision logic:

Require authorization + corresponding adjustment when:

- Credits will support compliance obligations (CORSIA, future EU schemes)

- You're making public "offsetting" or "carbon neutral" claims in Europe

- Board or investors demand highest-assurance credits

- You're in a high-scrutiny sector (finance, aviation, consumer brands)

High-integrity non-authorized credits are appropriate when:

- You frame purchases as "contribution" or BVCM financing, not offsetting

- You're building a diversified portfolio while waiting for 6.4 supply

- Projects meet all other quality bars (additionality, permanence, ICVCM alignment)

Document this stance in an internal policy that procurement, finance, legal, and comms teams can reference. Update it annually as Article 6 implementation matures and SBTi guidance evolves.

Update procurement criteria and governance

Translate your policy into procurement specs. Add these fields to every RfP and supplier questionnaire:

- Article 6 authorization status: Has the host country authorized these credits? For NDC use or other international purposes?

- Authorization documentation: Can you provide the host-Party letter, cooperative approach reference, or treaty basis?

- Corresponding adjustment: Will a corresponding adjustment be applied? When and how will it be reported (e.g., via UNFCCC CARP)?

- Registry labelling: Are units tagged in Verra, Gold Standard, or another registry with Article 6 status?

- Methodology and baseline: Which methodology? How was additionality demonstrated? Baseline conservativeness?

- Verification and MRV: Independent third-party verification? Digital MRV tools in use?

- Sustainable development safeguards: Evidence of community consultation, biodiversity protection, SDG alignment?

Use Senken's Sustainability Integrity Index (SII) to operationalize these checks at scale: 600+ data points across basic project details, carbon impact, beyond-carbon co-benefits, reporting process, and compliance/reputation cover most of these questions and more. With a <5% project acceptance rate, the SII pre-filters the market so your team reviews only high-integrity, Article 6-aware options.

Internally, align governance touchpoints: sustainability sets the policy, procurement writes the RfP, finance models the carbon price scenarios, legal reviews claims language, and the board receives an annual briefing on credit portfolio quality and Article 6 readiness.

Operationalising Quality, Due Diligence and Registries in an Article 6 World

What 'good' looks like: standards, labels and data

Prioritize credits with ICVCM Core Carbon Principles alignment, robust methodologies, independent verification, Article 6 labels in registries where relevant, and clear host-country authorization/adjustment evidence .

Look for these signals:

- ICVCM CCP-eligible or approved: The Integrity Council's Core Carbon Principles set a global quality bar; credits that meet CCP have passed rigorous additionality, quantification, permanence, and governance tests.

- Registry Article 6 tags: Verra and Gold Standard have introduced functionality to label credits authorized under Article 6, making traceability easier for buyers and auditors .

- Third-party ratings: Platforms like BeZero, Sylvera, and Calyx rate projects on integrity. Cross-reference these with your own due diligence.

- Transparent MRV: Projects using satellite monitoring, IoT sensors, or blockchain-based tracking reduce verification risk and provide ongoing proof of performance.

Red flags to avoid:

- No host-country authorization where one is claimed

- Missing or opaque registry records

- Reliance on outdated CDM vintages without clear transition evidence

- Methodologies that have been flagged by NGOs or excluded by major standards

- Lack of permanence plan or reversal buffer for removals

- No evidence of community engagement or safeguards

Building an audit-ready documentation pack

For every transaction, maintain contract data with project/program IDs and vintages; host-Party authorization letters indicating use purpose and entity authorization; corresponding adjustment evidence showing first transfer and intended national reporting; an integrity pack with methodology, verification reports, additionality tests, and permanence plans; and a claims substantiation file aligned with ESRS and Green Claims expectations .

Organize files by project and vintage. Store everything in a shared drive accessible to sustainability, finance, legal, and audit teams. When your external assurance provider asks for evidence, you hand over a complete folder—not a scramble through emails.

Senken's procurement platform delivers CSRD-ready evidence packs by default: registry screenshots, retirement certificates, project documentation, and SII scorecards that map to ICVCM and ESRS requirements. This turns audit prep from weeks into hours.

12–18 Month Action Plan to Get Your Company Article 6-Ready

Next 6 months: no-regret moves

Month 1–2: Portfolio and claims audit

Inventory current and contracted credits. Flag Article 6 gaps, legacy CDM exposure, and claims language that may not hold under Green Claims scrutiny. Present findings to leadership with a risk-and-opportunity framing.

Month 2–3: Supplier engagement

Contact existing credit suppliers. Ask about Article 6 authorization status, registry tagging, and plans for corresponding adjustments. Request updated documentation.

Month 3–4: Draft internal policy

Write a one-page "Carbon Credit and Article 6 Policy" that defines when you require authorized credits, acceptable contribution-only uses, quality thresholds (ICVCM, SII, third-party ratings), and claims language guardrails. Circulate for input from procurement, finance, legal, and comms.

Month 4–6: Align CSRD/ESRS reporting

Map your credit data to ESRS E1 disclosure requirements. Build the reporting template now so your 2025 or 2026 sustainability statement (depending on your CSRD phase-in) is ready. Train the finance team on what data they'll need to collect quarterly.

6–18 months: building long-term resilience

Month 6–9: Preferred supplier list

Identify 3–5 high-integrity providers or project developers who offer Article 6-ready credits and transparent documentation. Senken's curated marketplace, screened via the SII, shortlists the top 5% of projects globally—saving you months of due diligence.

Month 9–12: Explore 6.4 and 6.2 participation

With the Article 6.4 Supervisory Body advancing methodologies and first issuances expected in 2025–2026, and 58+ bilateral cooperative approach agreements already signed , monitor opportunities to participate directly or via intermediaries. Consider whether your company could co-finance a 6.4 activity or join a buyer coalition under a Swiss or other DACH 6.2 treaty.

Month 12–15: Integrate into carbon management systems

Add Article 6 fields (authorization status, adjustment evidence, registry tag) to your internal carbon accounting software or spreadsheets. Automate reporting where possible. Link to procurement approval workflows so no credit purchase bypasses the quality gate.

Month 15–18: Pre-build evidence for Green Claims

Ahead of the Directive's final entry into force, assemble full substantiation files for any external climate claim. Include scope definitions, credit documentation, independent verification, and plain-language explanations. Have legal review your marketing materials and website copy.

Ongoing: Stay informed

Article 6 is evolving. Subscribe to updates from the UNFCCC Article 6 hub, ICVCM, your carbon standard registries, and platforms like Senken that translate policy into practice. Budget for annual training so your team stays current.

Practical next step: Commission a portfolio and claims audit this quarter. Map your current credits against Article 6 criteria, CSRD disclosure needs, and Green Claims substantiation standards. Identify gaps and build a prioritized action list. Partner with a provider like Senken that embeds Article 6-relevant data, CSRD-ready evidence, and the Sustainability Integrity Index into every transaction—so your strategy is audit-proof and future-proof from day one.

.svg)